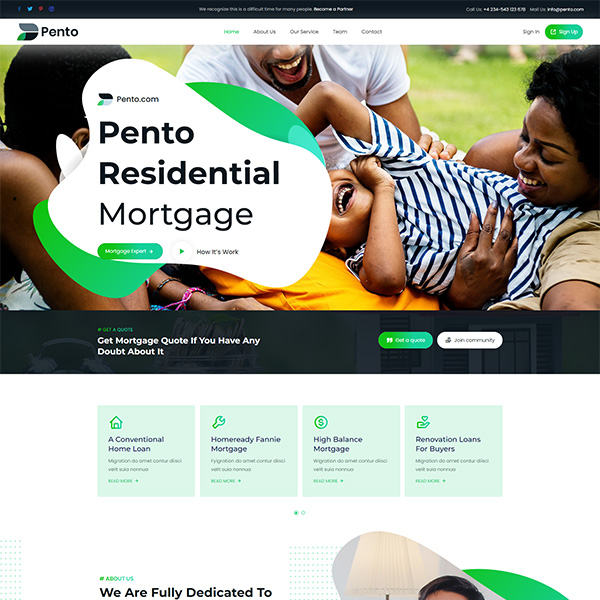

We Have a Wide Variety of Mortgage Loan Products

Speak to an Advisor

Find the mortgage solution that fits your goals. At Bond Street Mortgage, our experienced team of advisors are here to guide you through every step of the home financing process. Whether you’re buying your first home, refinancing, or passively shopping, we provide personalized advice to help you make confident decisions.

Talk to an Advisor